Federal employer identification number lookup

"An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity. If all else fails and you really cannot find your EIN on existing documents, you can reach out to the IRS by calling the Business & Specialty Tax Line at An Employer Identification Number (EIN) is also known as a Taxpayer Identification Number (TIN). A sole proprietorship that has no employees and files no. 3. Contact The IRS To Get Your EIN · Call the IRS Business & Specialty Tax Line at , which operates from a.m. to p.m., Monday through. If you're a professional preparer, enter your company's Employer Identification Number or your Social Security number.

Application for Employer Identification Number Farmers’ cooperative. Federal governmentOther nonprofit organization (specify) Highest number of employees expected in the next 12 months (enter if none). If no employees expected, skip line . An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity. Generally, businesses need an EIN. Legally, you are required to identify your business with one of two numbers: either your social security number or an employer identification number. Jan 19, · A federal tax ID lookup is a tool used to search for a company's details using their tax identification number or employer identification number. For company identification, the United States federal government uses a federal tax identification number. The federal tax identification number used by the federal government in the United States is.

The Employer Identification Number (EIN), also known as the Federal Employer Identification Number (FEIN) or the Federal Tax Identification Number. If all else fails and you really cannot find your EIN on existing documents, you can reach out to the IRS by calling the Business & Specialty Tax Line at The Internal Revenue Service (IRS) requires businesses to apply for a Federal Employer Identification Number (FEIN). Apply for an FEIN on the IRS website.

An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity. Generally, businesses need an EIN. Legally, you are required to identify your business with one of two numbers: either your social security number or an employer identification number. Employer Identification Number. The employer identification number is also known as a tax identification number and is assigned by the Internal Revenue Service. This number is required to file the company taxes. The number is the equivalent of a persons social security number, but for a business. An EIN is required by any business that: Hires. Apr 25, · EINs are a nine-digit number assigned by the Internal Revenue Service (IRS) to help identify businesses for tax purposes. It is essentially a Social Security number for a business. An EIN is sometimes referred to as a Federal Employer Identification Number (FEIN) or Federal Tax Identification Number (FTIN). Why do I need an EIN? An EIN is.

An Employer Identification Number (EIN) is also known as a Taxpayer Identification Number (TIN). A sole proprietorship that has no employees and files no. Visit your state's website to identify whether you need to get a state tax ID number in order to pay state taxes. Look up your state. Select.

Jan 19, · A federal tax ID lookup is a tool used to search for a company's details using their tax identification number or employer identification number. For company identification, the United States federal government uses a federal tax identification number. The federal tax identification number used by the federal government in the United States is. Employer ID Numbers (IRS Tax ID) Many times, small business owners get stuck midway through a loan application, tax return, or bank account application because they don't know their business tax ID number. Fortunately, locating your EIN is pretty simple. Here are the best way to look up your business Tax ID number. An EIN number lookup in NY is a way to find an Employer Identification Number, which is also called a Taxpayer Identification Number. Applying for an EIN isn't state specific, as it's done on the federal level. An EIN and TIN are the same thing. How and Where to Check an EIN. There are several ways to find an EIN.

Registration common mistakes; Ready to register; License No Tax Due Federal Employer Identification Number (FEIN), if applicable issued by the Internal. Your EIN may also be referred to as your Federal Employer Identification Number, or FEIN. Any business that requires an EIN at the federal level will also. Search. Home · About · Real Property · Businesses · Forms · Reports · Tax is actually called a “Federal EIN” (Federal Employer Identification Number). If you're a professional preparer, enter your company's Employer Identification Number or your Social Security number.

Jan 19, · A federal tax ID lookup is a tool used to search for a company's details using their tax identification number or employer identification number. For company identification, the United States federal government uses a federal tax identification number. The federal tax identification number used by the federal government in the United States is. An EIN number lookup in NY is a way to find an Employer Identification Number, which is also called a Taxpayer Identification Number. Applying for an EIN isn't state specific, as it's done on the federal level. An EIN and TIN are the same thing. How and Where to Check an EIN. There are several ways to find an EIN. Employer Identification Number. The employer identification number is also known as a tax identification number and is assigned by the Internal Revenue Service. This number is required to file the company taxes. The number is the equivalent of a persons social security number, but for a business. An EIN is required by any business that: Hires.

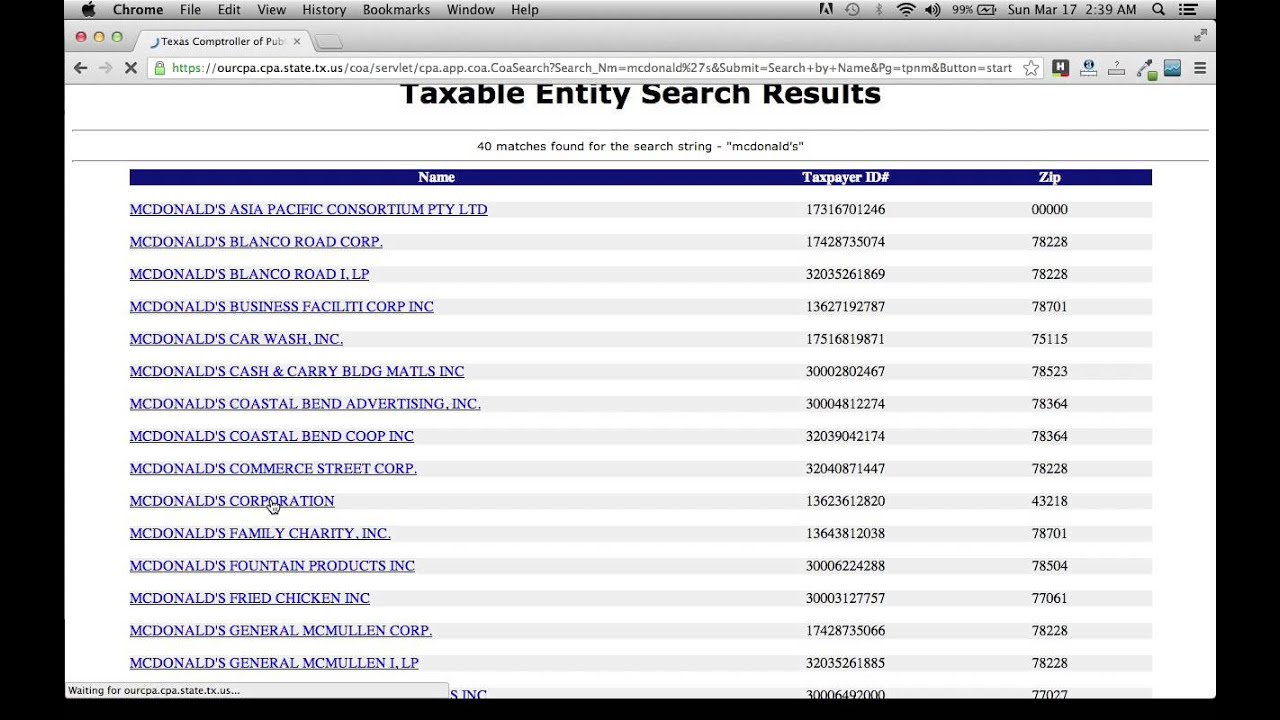

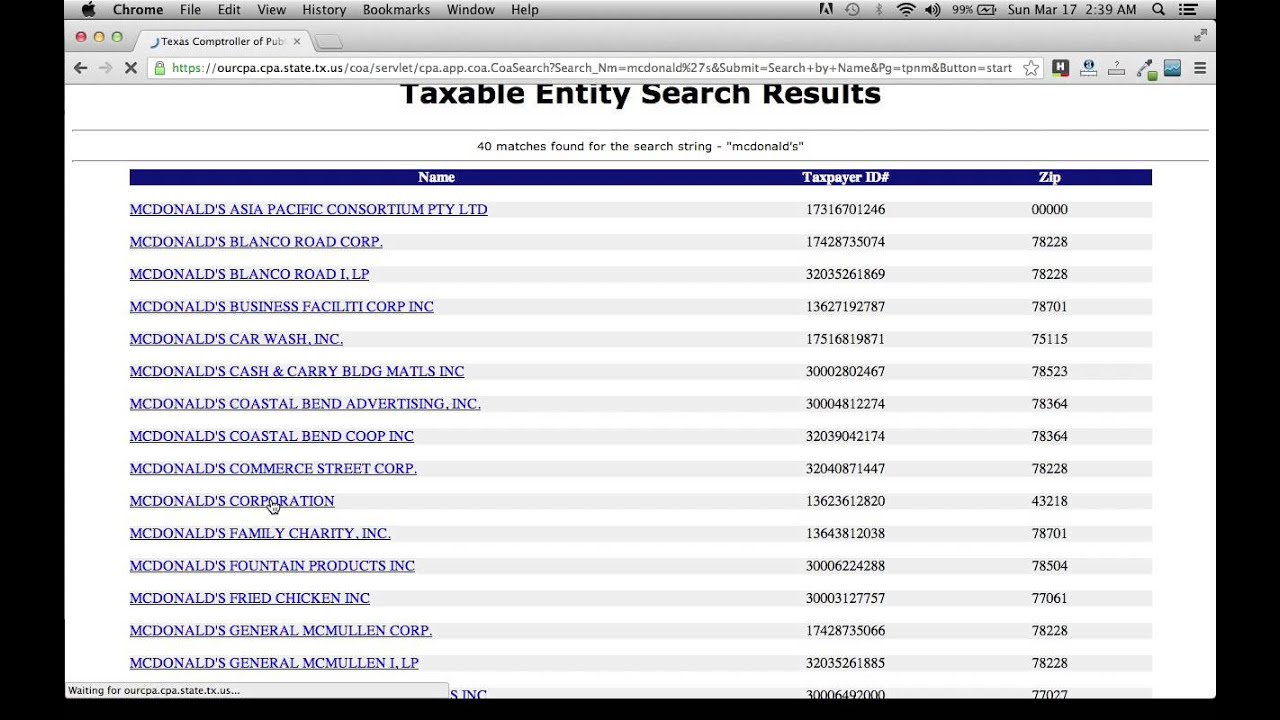

A Federal Tax Identification Number, also known as a "95 Number", "E.I.N. Number," or "Tax I.D. Number", all refer to the nine digit number issued by the. Employer Identification Number (EIN) IRS Form SS-4 to apply for an EIN. PLC US Employee Benefits and Executive Compensation, PLC US Federal. Tax Id All Routing Numbers of Citizens Bank Na A routing number is a Taxpayer Number or the 9-digit Federal Employer's Identification Number. An Employer Identification Number (EIN) is also known as a Taxpayer Identification Number (TIN). A sole proprietorship that has no employees and files no. Search. Tax ID. Use the digit Comptroller's Taxpayer Number or the 9-digit Federal Employer's Identification Number. OR. Entity Name. OR. File Number.

Federal employer identification number lookup - Employer ID Numbers (IRS Tax ID) Many times, small business owners get stuck midway through a loan application, tax return, or bank account application because they don't know their business tax ID number. Fortunately, locating your EIN is pretty simple. Here are the best way to look up your business Tax ID number.

VIDEO

How do you find your employer identification number?

Federal employer identification number lookup - Employer Identification Number. The employer identification number is also known as a tax identification number and is assigned by the Internal Revenue Service. This number is required to file the company taxes. The number is the equivalent of a persons social security number, but for a business. An EIN is required by any business that: Hires.

You were visited with remarkable idea

This phrase is necessary just by the way

I am final, I am sorry, but, in my opinion, it is obvious.